Notes:

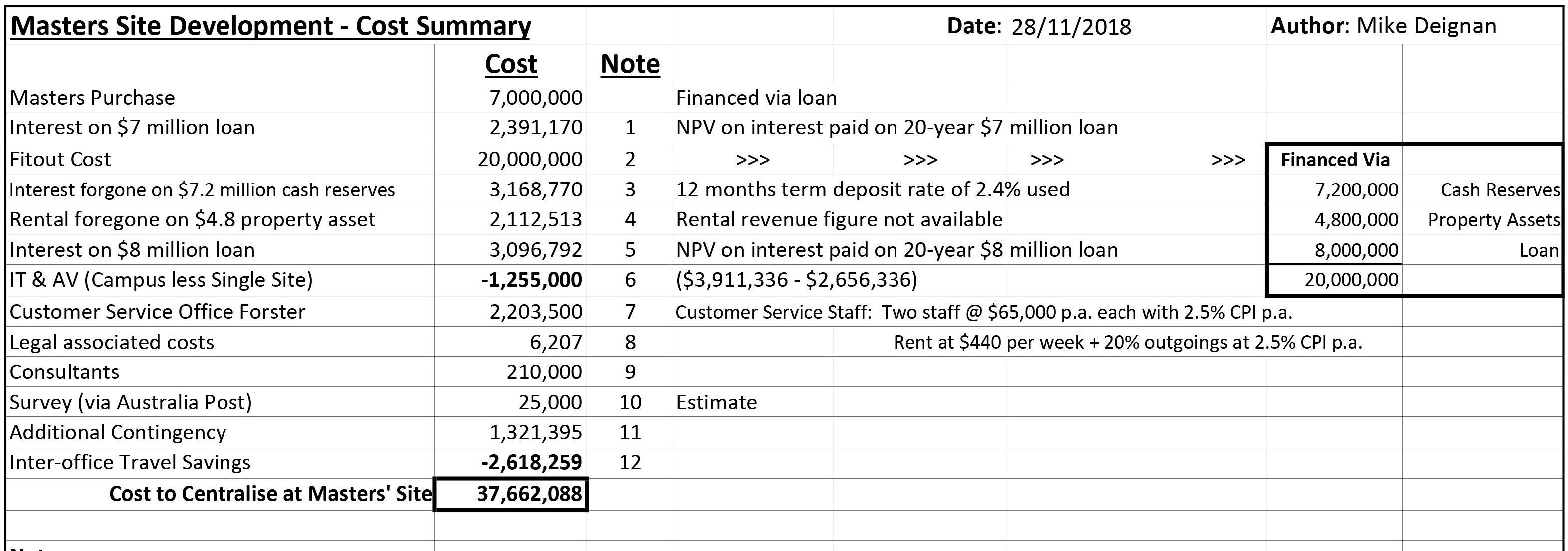

- Todays cost (i.e. net present value) of interest part of monthly payments on 20-year $7 million loan

Monthly amounts are summed to get annual amount and then discounted (compound interest calculation) to get net present value.

The discount rate is the same rate as used in the Syneca part of the Business Case.

- Draft Financing Strategy (Council Ordinary Meeting 31 October 2018)

-

Where interest-earning Cash Reserves are used then interest foregone must be charged as a cost to Masters’ centralisation.

-

As property assets rental income figures are not available, a conservative cost is derived by assuming the proceeds from Property Asset sales are placed on term deposit. Interest on the term deposit is compounded annually at NAB rate of 2.4% pa.

Net present value is derived similar to other NPV calculations.

- Similar to calculation on $7 million loan

-

IT and AV costs are less for Masters’ than the campus option. Therefore the difference in initial costs are added back to reflect a saving.

-

Currently in Forster there is “one” building holding administration centre with integral customer service centre.

Masters will have a new centralised administration centre with a separate customer service office in Forster.

The latter must be costed and included in the Masters site costings.

-

Legal costs, just on purchase of Masters’ site and supplied by MCC (27/11/2018)

-

Costs supplied by MCC. (understated) Consultants: Savills/Syneca, Montlaur, Slatterys, RSM and Knight & Frank)

-

61,000 survey flyers distributed by Australia Post. Distribution cost plus $1.53 per post paid return (MCC processing costs ignored)

-

MCC have included a 10% contingency on just the fitout cost. The contingency should include highly variable costs

-

The Business Case (page 17) gives the staff cost saving per year due by moving to Masters. Applying 4% CPI and discounting gives the NPV savings